Canada-Wide Early Learning and Child Care Agreement

For any questions or if you need additional information

Email [email protected]

- Implement the new cost-based funding formula.

- Enhance the directed growth application process to accelerate the creation of new affordable child care spaces to meet the needs of the community.

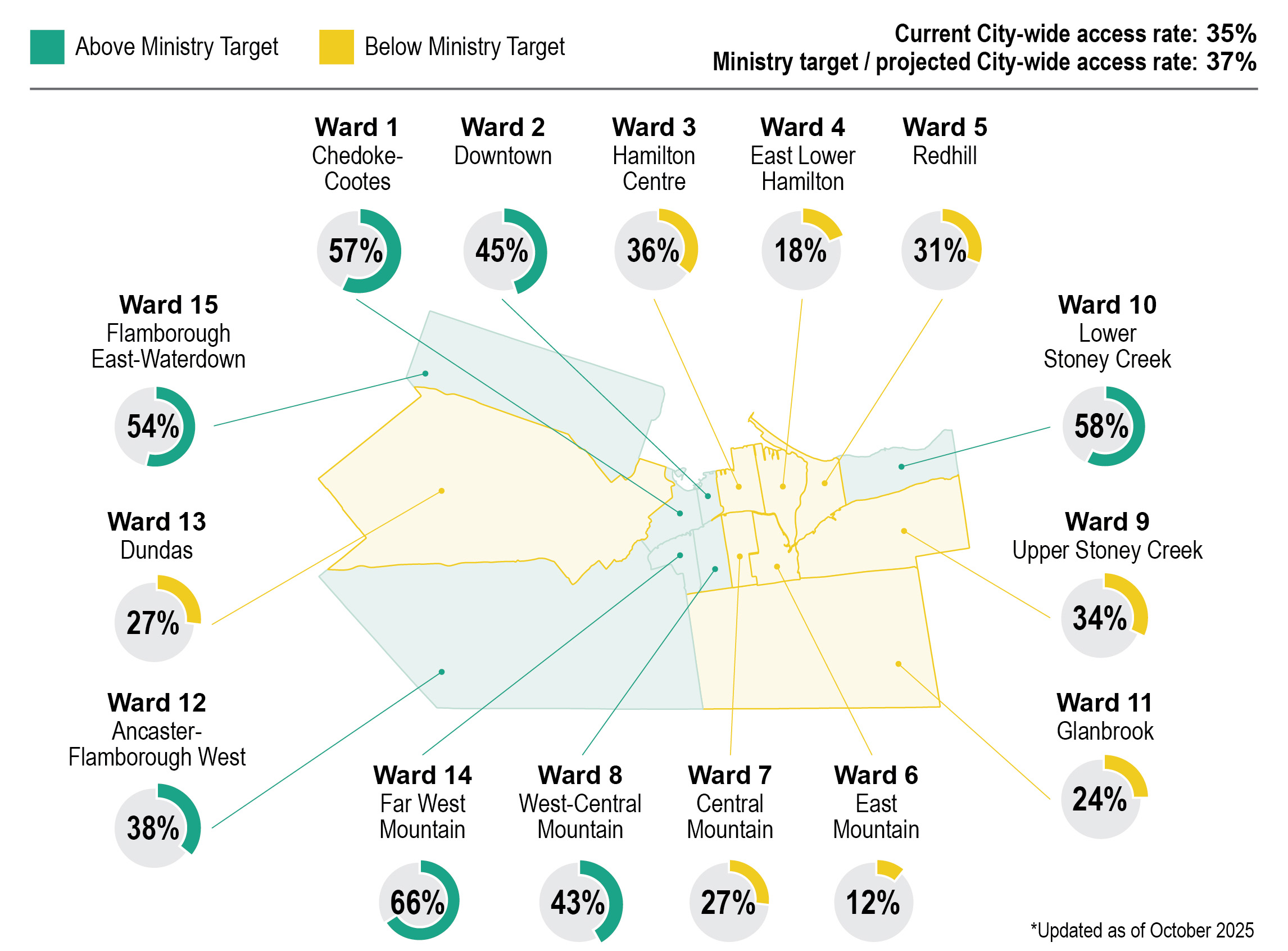

- Increase child care access rates, which are currently below the provincial target of 37%, through a city-wide directed growth application process.

- Create 339 new community-based child care spaces in 2025 with 302 approved for 2026, totaling 641 brand new affordable spaces by 2026.

- Strengthen equity, diversity, inclusion and belonging within the affordable child care system.

- Develop additional strategies to grow attract, retain and sustain a high-quality workforce.

Child Care Directed Growth Application - Now Closed

All applications submitted prior to September 30, 2025 have been reviewed and all applicants have been informed of decisions. Review the Child Care Directed Growth Application tab below to learn more about operating a child care centre in Hamilton.

The CWELCC plan is designed to provide high-quality, affordable, accessible and inclusive licensed child care programs to support Ontario’s children, families, employers, early years professionals and the child care sector. This plan aligns with the priorities for the Early Years System in Hamilton - affordability, accessibility, inclusion and quality.

All growth in CWELCC, both centre based and licensed home child care, will be approved through the City's directed growth application process. Licensees looking to open a new child care site can open outside of the CWELCC system and do not need to complete a Directed Growth Application.

The Ministry of Education is responsible for licensing and compliance. All new licence requests and licence revisions are completed on the Child Care Licensing System. For more resources review Start a child care program.

Participating licensees in the Canada-Wide Early Learning and Child Care system in Hamilton are listed here: Financial Support for Child Care.

2025 Goals

- Implement the new cost-based funding formula.

- Enhance the directed growth application process to accelerate the creation of new affordable child care spaces to meet the needs of the community.

- Increase child care access rates, which are currently below the provincial target of 37%, through a city-wide directed growth application process.

- Create 339 new community-based child care spaces in 2025 with 302 approved for 2026, totaling 641 brand new affordable spaces by 2026.

- Strengthen equity, diversity, inclusion and belonging within the affordable child care system.

- Develop additional strategies to grow attract, retain and sustain a high-quality workforce.

2024 Accomplishments

- Hamilton’s Early Years System reaffirmed its commitment to Equity, Diversity, Inclusion, and Belonging, by signing off on the City’s Equity, Diversity, Inclusion and Belonging (EDIB) Policy.

- Launched the OurHamilton Inclusion Policy, which included a webinar with 216 registered participants and workshops attended by 130 child care and EarlyON staff to support early years providers in creating or updating their inclusion policies.

- Completed cost-based funding formula information sessions for centre-based licensees and licensed home child care agencies.

- Continued engaging with Hamilton’s Early Years System and families to inform expansion of child care spaces.

- Created 265 new community-based child care spaces, prioritizing Wards with child care access rates less than 37%.

- Showcased stories of local early childhood educators to highlight and market the value of the profession in the labour market.

- Implemented Ontario’s Ministry of Education Child Care Workforce Strategy, introducing local strategies to grow, attract, retain and sustain a high-quality workforce. This included implementing two professional development days for more than 2,000 early years professionals.

2023 Accomplishments

- Reduced child care fees by 52.75%, saving Hamilton families an estimated $9,100 on child care per child in 2023.

- Expanded funding agreements with six licensed child care licensees to increase access to child care across Hamilton.

- Developed an Access and Inclusion Framework to direct growth in Hamilton’s licensed child care system to best serve the needs of the community.

- Engaged 331 families through 10 community-based service providers to gain a better understanding of child care needs and barriers to access, to inform child care expansion plans.

- Met the Ontario Ministry of Education’s community-based child care space target of creating 381 new child care spaces across the community.

- Implemented an Early Childhood Educator Workforce Grant pilot to support more than 450 Early Childhood Educators (ECEs) with the cost of child care, resulting in improving retention and reducing barriers to employment. ECEs reported improved family well-being and reduced household debt as a result.

- Implemented an affordability grant pilot to reduce the cost of before and after school child care to $15/day for children aged 6-12 years transitioning out of the CWELCC age window.

- Launched the new fee subsidy client portal which has streamlined communication, enhanced document security, improved efficiency and enabled better case management.

- Launched an Early Childhood Educator marketing campaign focusing on the important role they play in the community and in supporting child development. This resulted in more than 8,000 views and comments on the City’s social media channels.

- Partnered with Atkinson Centre for Society and Child Development and 43 other Service System Managers across the province to implement the “Knowing Our Numbers Survey” to learn more about the early years workforce. These results will help inform future workforce strategies to grow, attract, retain and sustain a high-quality workforce in Hamilton.

- Implemented two successful professional development days for more than 2,000 early years professionals.

- Increased the number of special needs children who received child care service support.

Guidelines, Framework & Application Resources

Licensee Resources

Visit Child Care Licensee Resources for all forms, guides, and tools for Licensees operating in the City of Hamilton.

Frequently Asked Questions

for families to provide high-quality child care. Additionally, you will have access to fee subsidy supports, the City of Hamilton's early years quality program, special needs resourcing staff support and professional learning support for educators through Affiliated Services for Children and Youth (ASCY). Licensees serving children aged 0-5 who do not participate in CWELCC are not eligible for these supports.

Parents will benefit from reduced daily child care fees until their child reaches the age of five.

Effective January 1, 2025, Ontario’s Ministry of Education has capped daily child care to $22/day. The goal is to reduce fees further to an average of $12/day by March 2026.

Yes, you can. Licensees who choose not to participate in CWELCC may operate under the existing provincial licensing and regulatory framework. Prospective licensees can apply for a licence through the Child Care Licensing System and indicate “No” to CWELCC participation. They do not need to complete a Directed Growth Application but will not receive CWELCC-related supports or funding.

Yes. Any growth within the CWELCC system for children aged 0-5 requires a Directed Growth Application. A licence request will only be approved if the Directed Growth Application is completed, submitted, and approved for community-based child care spaces. Participation in CWELCC is not guaranteed.

Applicants submitting a Directed Growth Application will have an opportunity to apply for a start-up grant. Eligibility is limited to successful applicants of the Directed Growth Application process. Licensees are ineligible if they are school-based, choose to operate outside of CWELCC, or are already operational and wish to enroll an existing program into CWELCC. For detailed eligibility criteria, refer to the City of Hamilton Access and Inclusion Framework

No. The City of Hamilton does not provide funding agreements for fee subsidy, general operating expenses or system priority funding. Licensees serving children 0-5 who are not participating in CWELCC are not eligible for these supports.