Vacant Unit Tax

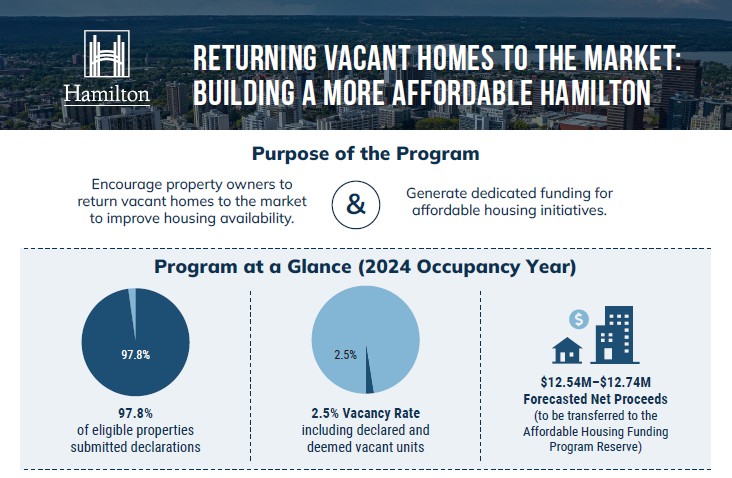

- 97.8% of eligible properties submitted declarations

- 2.5% Vacancy Rate including declared and deemed vacant units

- $12.54M to $12.74M Forecasted Net Proceeds for Affordable Housing Funding Program Reserve

Monday, February 9, 2026, 9:30 to 11:30 a.m.

Westmount Recreation Centre

35 Lynbrook Dr., Hamilton

Tuesday, February 10, 2026, 9:30 to 11:30 a.m.

Hamilton Public Library – Sherwood Branch

467 Upper Ottawa St., Hamilton

Wednesday, February 11, 2026, 9:30 to 11:30 a.m.

Valley Park Community Centre and Arena

970 Paramount Dr., Stoney Creek

Wednesday, February 11, 2026, 1:30 to 3:30 p.m.

Glanbrook Municipal Service Centre

4280 Binbrook Rd., Binbrook

Thursday, February 12, 2026, 9:30 to 11:30 a.m.

Hamilton Public Library – Dundas Branch

18 Ogilvie St., Dundas

Thursday, February 12, 2026, 1:30 to 3:30 p.m.

Ancaster Rotary Centre and Morgan Firestone Arena

385 Jerseyville Rd. W., Ancaster

Friday, February 13, 2026, 9:30 to 11:30 a.m.

Harry Howell Arena

27 Hwy 5 W., Flamborough

Friday, February 13, 2026, 1:30 to 3:30 p.m.

Sir Allan McNab Recreation Centre

145 Magnolia Dr., Hamilton

Wednesday, February 18, 2026, 9:30 to 11:30 a.m.

Sir Winston Churchill Recreation Centre

1709 Main St. E., Hamilton

Wednesday, February 18, 2026, 1 to 3 p.m.

Bernie Morelli Recreation Centre

876 Cannon St. E., Hamilton

Thursday, February 19, 2026, 10 a.m. to 12 p.m.

Kanétskare Recreation Centre

251 Duke St., Hamilton

Thursday, February 19, 2026, 1 to 3 p.m.

Bennetto Community Centre

450 Hughson St. N., Hamilton

Friday, February 20, 2026, 9:30 to 11:30 a.m.

Winona Community Centre

255 Winona Rd., Stoney Creek

Friday, February 20, 2026, 1 to 3 p.m.

Sir Wilfrid Laurier Recreation Centre

60 Albright Rd., Hamilton

Thursday, February 26, 2026, 10 a.m. to 12 p.m.

Flamborough Seniors Centre

163 Dundas St. E., Hamilton

For additional information

Call 905-546-2573

Email [email protected]

Note: Long distance charges may apply for calls outside of Hamilton. Please check with your telephone service provider.

Declaration Period Open for 2025

All Residential Property Owners are required to submit a mandatory occupancy declaration for the 2025 tax year including your principal residence. A property’s occupancy may change year-over-year, an annual declaration ensures the City has accurate information about how residential properties are being used.

- Complete your residential Vacant Unit Tax Declaration by April 15, 2026.

- Late Declarations will be accepted from April 16 to May 15, 2026 with a Late Declaration Fee of $250.

Submitting your Declaration

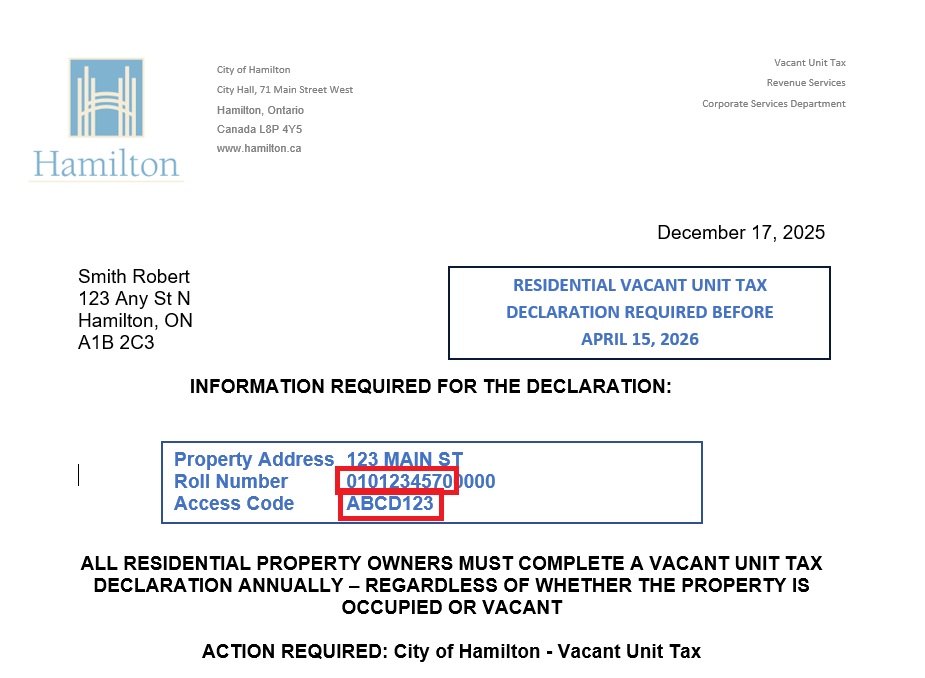

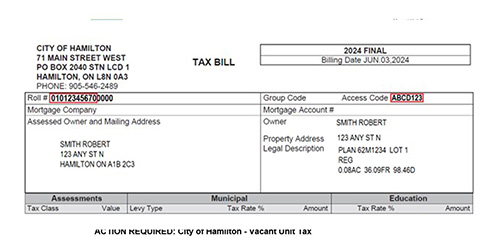

To complete your annual Vacant Unit Tax declaration, you will need your access code and roll number. These can be found on the Notice to Declare letter sent to you by mail in December 2025 or on your most recent property tax bill from the City of Hamilton.

To complete your online Vacant Unit Tax declaration with the City of Hamilton, follow these steps:

- Gather Necessary Information:

- Locate your roll number and access code. These can be found on your Notice to Declare letter or your most recent property tax bill from the City of Hamilton.

- Access the Declaration Portal:

- Visit my.hamilton.ca to access the declaration portal.

- Create an Account:

- Select "Sign up now" to create a new account.

- Follow the prompts to set up your account.

- Update Contact Information:

- After creating your account, enter your contact details.

- Click "Update" to save the information.

- Begin a New Submission:

- o Ensure you're signed in (your name should appear in the top right)

- Click on "Make a new Submission”

- Select "Submit a Declaration"

- Review Important Information:

- Read the "Notice of Collection" statement and click "Start."

- Review the background information on the Vacant Unit Tax program, noting key dates.

- Click "Accept and Continue."

- Verify Property Eligibility:

- Enter your roll number (excluding the last four zeros) and access code.

- Click "Verify."

- Confirm Property Information:

- Review the displayed property details.

- If correct, click "Confirm and Continue."

- Specify Submission Role:

- From the drop-down menu, indicate whether you're submitting as the property owner or on behalf of the owner.

- Ensure your contact information is accurate.

- Click "Next."

- Declare Occupancy Status for Each Unit:

Residential property owners must submit the status of each unit within the property. The City uses the Municipal Property Assessment Corporation (MPAC) property code to determine how many units are contained in a residential property. For example, a duplex would contain two units within the property.- For each unit, click "View/Edit Unit Details."

- Select the appropriate occupancy status:

- Principal residence

- Occupied by tenants

- Occupied by permitted occupants

- A combination of occupancy

- None of the above (if the unit was vacant for more than 183 days)

- If “None of the above” is selected for any of the following reasons, select which exemption applies:

- Death of an owner: the exemption applies to the year of death, plus one subsequent year only.

- Major renovations: major renovations or redevelopment make occupation of a unit impossible for more than 183 days in the same calendar year, provided a building permit has been issued.

- Sale of the property: the Vacant Unit Tax will not apply in the year of the sale if the transfer is to an unrelated individual or corporation.

- Principal resident is in care, institutionalized or hospitalized: the period of time when the principal resident resides in a hospital, long-term or a supportive care facility.

- Court order: if a court order prohibiting occupancy of the residential property is in effect.

- Non-profit housing: the exemption applies to designated housing projects owned and operated by non-profit corporations.

- Click "Submit."

- Repeat this process for each unit on the property.

- Verify Occupancy Types: Ensure the occupancy type listed for each unit is correct.

- Click "Next."

- Review and Submit Declaration:

- Review your declaration summary.

- Check the box to acknowledge that the provided details are correct and up to date.

- Click "Submit."

- Confirmation:

- A confirmation email with your declaration details will be sent to the email address provided.

Online Declarations

Visit my.hamilton.ca to complete your declaration.

If you have any issues completing your declaration, please contact the Vacant Unit Tax team by email at [email protected] or by phone at 905-546-2573.

Declaration by Phone

Declarations can also be submitted by calling 905-546-2573. Note: Long distance charges may apply for calls outside of Hamilton. Please check with your telephone service provider.

Declaration by Email, Mail or In-person

- Email - Send completed form to [email protected]

- Mail or In-person - Printed declaration forms will be accepted in person at any Municipal Service Centre, or by mail to

Vacant Unit Tax

71 Main Street West

Hamilton, ON, L8P 4Y5 - You can schedule an in-person appointment by phone at 905-546-2573.

To receive a declaration submission confirmation, all sections of the declaration form must be completed and signed. Declaration confirmations will be sent by email (if an email is provided on the form).

Key Dates

- Declaration Period Opened: December 17, 2025

- Deadline: April 15, 2026.

- Late Declaration Deadline with a late declaration fee: May 15, 2026

Consequences of Non-Submission

If a mandatory declaration is not submitted by the late declaration deadline of May 15, 2026, the residential unit will be considered vacant, and the Vacant Unit Tax will be charged.

Submitting your Appeal

Hamilton homeowners who believe their property was wrongly identified as vacant or were unable to submit their declaration can dispute the Vacant Unit Tax by submitting an appeal. To dispute the Vacant Unit Tax charge added to your property tax account, you will need your access code and roll number. These can be found on the Vacant Unit Tax bill sent to you by mail in June 2025 or on your most recent property tax bill from the City of Hamilton.

Key Dates

- 2025 Taxation Year Appeal Period Opens: June 15, 2026

- Deadline: 120-days from the VUT bill date

Online Appeal

Visit my.hamilton.ca to complete your appeal online.

If you have any issues completing your appeal, please contact the Vacant Unit Tax team by email at [email protected] or by phone at 905-546-2573.

Appeal by Phone

Appeals can also be submitted by calling 905-546-2573. Note: Long distance charges may apply for calls outside of Hamilton. Please check with your telephone service provider.

Appeal by Email, Mail or In-person

- Email - Send completed forms to [email protected]

- Mail or In-person - Printed appeal forms will be accepted in person at any Municipal Service Centre, or by mail to:

Vacant Unit Tax

71 Main Street West

Hamilton, ON, L8P 4Y5 - You can schedule an in-person appointment by phone at 905-546-2573.

Program Details

The Vacant Unit Tax is an annual tax payable by the owner of a residential unit that has been vacant for more than 183 days in the previous calendar year. All owners of residential units must submit an annual mandatory declaration on the status of their property. If a mandatory declaration is not submitted, the residential unit will be considered vacant, and the Vacant Unit Tax will be charged.

A principal residence will not be subject to the Vacant Unit Tax, but it is still required to submit a mandatory declaration.

A residential unit may be considered vacant by the City and subject to the tax if the owner:

- failed to make a mandatory declaration by the prescribed deadline

- failed to provide information or failed to submit any evidence required by the City

The Vacant Unit Tax will be added to the tax roll and collected in the same manner as property taxes.

If the residential unit has been declared vacant for more than 183 days in the previous calendar year and does not meet one of the exceptions, the Vacant Unit Tax will be applied. The first year the Vacant Unit Tax will be payable is 2025, based on the status of the property in 2024.

The Vacant Unit Tax will be calculated at a rate of one percent of the property's current assessed value and will be issued as a tax bill, mailed in June 2026.

- Late Mandatory Declaration Fee: $250

- Non-Declaration Fee: $250

- Penalties and Interest: Penalty of 1.25% on the first day of default, plus 1.25% interest per month.

- Other offences: Set in the Vacant Unit Tax by-law

To learn more about numerous other tools and programs underway by the City to help make more housing available, including investments in affordable housing units, support for non-profit housing providers, rent subsidy programs, and investments in homelessness outreach and emergency shelters, please visit www.hamilton.ca/housing.

Key Dates

| DATE | DETAILS |

|---|---|

| December 2025 | Notice to Declare Letters with declaration instructions will be mailed to property owners |

| December 17, 2025 | Declaration period opens for the 2025 tax year |

| April 15, 2026 | Mandatory declaration deadline |

| May 15, 2026 | Late declaration deadline |

| First week of June 2026 | Vacant Unit Tax charges will be included on a VUT tax bill |

| June 15, 2026 | Appeal period begins |

| June 30, 2026 | First Vacant Unit Tax payment is due if on the quarterly plan * |

| September 30, 2025 | Second Vacant Unit Tax payment is due if on the quarterly plan * |

* Note: If you are on a Pre-Authorized Payment (PAP) Plan and would like the Vacant Unit Tax included with your scheduled Property Tax Payment Plan, please visit www.hamilton.ca/payyourpropertytax or email [email protected].

Frequently Asked Questions

What is the definition of a vacant unit?

A residential unit is considered vacant if it has been unoccupied for more than 183 days during the previous calendar year.

When will I need to submit the declaration?

Declarations for the 2025 tax year can be submitted starting December 17, 2025, and must be completed by April 15, 2026.

Late Declarations will be accepted until May 15, 2026 with a Late Declaration fee of $250.

Where do I find the declaration form?

The declaration form will be available starting December 17, 2025. Notice to declare letters were mailed out to eligible property owners in early Decmber 2025. Declarations can be submitted:

- online

- over the phone at 905-546-2573

- by email to [email protected]

- mailed to Vacant Unit Tax 71 Main Street West. Hamilton, ON, L8P 4Y5

- in-person at a Municipal Service Centre

What happens if I do not submit my declaration by the due date?

Declarations are mandatory. If a mandatory declaration is not submitted, the residential unit will be considered vacant and the Vacant Unit Tax will be charged.

Which properties are eligible for the Vacant Unit Tax?

The Vacant Unit Tax applies to all properties that are classified as residential, such as single-family detached, townhouses, row homes, duplex, triplex, etc.

How is the Vacant Unit Tax calculated and charged?

The Vacant Unit Tax is calculated as a percentage of the property’s current assessed value.

Council approved a tax rate of 1% of a property’s assessed value as determined by MPAC. For example, this would result in a $3,850 Vacant Unit Tax on a residential unit with an assessed value of $385,000.

Properties that have been determined vacant will be charged the Vacant Unit Tax on a VUT bill. If on a quarterly plan, payments are due on June 30 and September 30, 2025. If on a Pre-Authorized Payment (PAP) Plan, the Vacant Unit Tax will coincide with your payment plan.

Who is responsible for declaring that their principal residence is vacant, and how do they do that?

The property owner is responsible for submitting the declaration. Declarations can be submitted online or over the phone at 905-546-2573. Print declaration forms will also be accepted in person at one of the City’s Municipal Service Centres, by mail to Vacant Unit Tax. 71 Main Street West, Hamilton, Ontario. L8P 4Y5, or via email at [email protected].

Declaration confirmations will be sent by email (if an email is provided on the form).

What do I need to properly fill out the annual declaration?

To complete your annual declaration, you’ll need an access code and roll number. These can be found on the Notice to Declare letter sent to you by mail in December 2025 or on your most recent property tax bill from the City of Hamilton. If a residential property owner does not receive a Notice to Declare letter, they can contact the Vacant Unit Tax team by email at [email protected] or by phone at 905-546-2573.

Who can submit the annual declaration of a property?

The annual declaration must be submitted by the property owner or someone authorized to declare on their behalf.

I own more than one residential property; do I need to submit more than one declaration?

Yes. A declaration must be submitted for each residential property.

I own a duplex / triplex / fourplex / fiveplex / sixplex, do I need to declare for each unit?

Yes. Residential property owners must submit the status of each unit at the property. The City uses the MPAC property code to determine how many units are contained in a residential property. For example, a duplex would contain two units within the property.

There is more than one owner of my property; do we each need to submit a declaration?

No. Only one declaration is required for each residential property.

Do I have to fill out this declaration form every year? Even if I live there? If so, why? Will the City send me a letter each year to prompt me or do I have to proactively complete and submit the form each year?

Yes, an annual declaration will be required each year. Declarations are required annually to ensure that the Vacant Unit Tax is applied accurately and reflects any changes in how the property was used. This is the most effective and reliable method available to the City to ensure all property occupancy changes are captured.

The City will remind property owners to make the annual declaration every year by mailing or emailing a notice to declare letter.

Is there an option/consideration for people who go south for the winter and are not here in February (Snowbirds)?

Declarations can be completed online or by phone at 905-546-2573. If property owners are away during the declaration period (December 17, 2025 to May 15, 2026), they can authorize someone else to complete the declaration on their behalf.

Where is the information collected on the Vacant Unit Tax declarations being stored?

Information collected in order to process Vacant Unit Tax declarations are only stored and processed in servers located in Canada. The City of Hamilton collects information under authority of the City of Hamilton By-Law No. 25-201 a By-Law to Establish a Vacant Unit Tax, and 'Section 227 of the Municipal Act, 2001'. Any personal information collected for the Vacant Unit Tax will be used for the purpose of administering the Vacant Unit Tax and enforcement of the by-law. Updated as of March 4, 2025.

Questions about the collection of this personal information can be directed to Manager, Vacant Unit Tax, 71 Main St W, 1st Floor, Hamilton, ON L8P 4Y5, by phone at 905-546-2573, or by email at [email protected].

Will Vacant Unit Tax Submissions be audited?

The City of Hamilton will audit mandatory occupancy declarations for accuracy on an annual basis. Your property may be audited for the following scenarios:

- Random selection

- A complaint or tip

- Properties that report an exemption

- Properties declared occupied that were vacant the previous year

- Targeted audit campaigns

- Residential properties reported vacant in the Vacant Building Registry (registered and unregistered)

Are there fines and penalties if my property is audited?

Residential Property Owners may be subject to a fine up to $10,000 for providing false information with the intent to evade the Vacant Unit Tax charge.

Why do I have to submit an occupancy status declaration if I was charged the Vacant Unit Tax?

You need to complete an occupancy status declaration to dispute the Vacant Unit Tax through an appeal. All residential property owners must submit this declaration every year, which tells the City whether your home was vacant or occupied.

What supporting documents am I required to submit when disputing my Vacant Unit Tax charge?

The required supporting documentation is determined by the occupancy status of the residential property.

| Occupancy Status for 2024 | Required Supporting Documentation |

|---|---|

Property Owner’s Principal Residence Please include Government Issued Photo Personal Identification Card and two additional documents. |

|

| Occupied by Tenant(s) for more than 183 days |

|

Permitted Occupant’s Principal Residence for more than 183 days Please include Government Issued Photo Personal Identification Card and two additional documents |

|

Exemptions Residential Property was occupied for 183 days or less

| Exemption | Required Supporting Documentation |

|---|---|

| Death of an Owner |

|

| Major Renovation |

|

| Sale of the Property |

|

| Resident in a Care Facility |

|

| Court Order |

|

| Non-Profit Housing Unit |

|

What other documents am I required to submit when disputing my Vacant Unit Tax charge?

If you are acting on behalf of the property owner, you are required to submit a Schedule A – Signed Written Authorization (Consent) Form.

If my first appeal request is unsuccessful, what are my next steps?

If you disagree with the result of your first appeal, you can file a second appeal within 60 days of the decision. Second appeals are completed by a reviewer who was not involved in your original first appeal submission. Second appeal decisions are final.

How fast will my appeal take for a decision?

The City will provide an appeal written response within 90 days from receiving all required information and supporting documentation.

If my appeal is successful, when will the Vacant Unit Tax charge be removed from my property tax account?

If your appeal is successful, the City will refund all or part of the Vacant Unit Tax and any related interest or penalties within 120 days of the decision.

Why did this program get implemented and when?

The Vacant Unit Tax program was approved by Council in June of 2022 as one of the measures to address the City’s housing crisis. By creating an incentive for property owners to sell unoccupied homes or make them available as rentals, the City aims to make more housing available for those who need it.

What other municipalities use a Vacant Unit Tax?

Vancouver’s Empty Homes Tax has been in effect since 2017.

Toronto approved a Vacant Home Tax and Ottawa approved a Vacant Unit Tax beginning in 2023.

Why must all eligible property owners declare?

Staff have reviewed several residential Vacant Unit Tax programs globally to determine how residential Vacant Unit Tax has been implemented. The programs use one of three different methodologies:

- Mandatory Declaration

- Voluntary Vacant Unit Declaration: Property owners would voluntarily declare vacancy in good faith and be taxed by the City.

- Complaint-Based: Vacant properties would be identified through a complaint or tip from residents

In all cases, programs that used the Voluntary Vacant Unit Declaration or Complaint-Based method have been ineffective in capturing vacant units and reducing vacancies in the cities. In comparison, those using the mandatory declaration have had much more success.

Why can’t the City get information from utility companies to identify vacant properties?

The City does not have access to that information as it is protected under the Municipal Freedom of Information and Protection of Privacy Act (MFIPPA). Further, water and hydro usage data would not accurately indicate how the property was occupied. For example, a principal residence could record low usage due to travel, work contracts, extensive renovations, military postings, or schooling.

If a building permit or demolition permit is issued, will the Vacant Unit Tax apply?

If major renovations or redevelopment make it impossible to occupy a unit for more than 183 days, the tax will not apply, provided that a building permit has been issued. However, residential property owners are still required to submit a declaration with the appropriate exemption.

Does the Vacant Unit Tax apply to “granny suites”?

All residential properties are required to submit a declaration. However, any units, such as accessory or “granny suites,” contained in a residential property do not require a declaration.

Does the Vacant Unit Tax apply to vacant land or lots that have been subdivided but not developed?

No, the Vacant Unit Tax only applies to residential properties and not vacant land.

Documents

Public Engagement

The City conducted a Vacant Home Tax online engagement survey from September 7 to 30, 2021. The goal of the survey was to collect feedback from interested stakeholders on the need to implement a tax on properties that are left vacant for a certain period of time, as well as possible issues to consider in implementing the tax.