Understanding Your Property Tax Bill

About Your Tax Bill

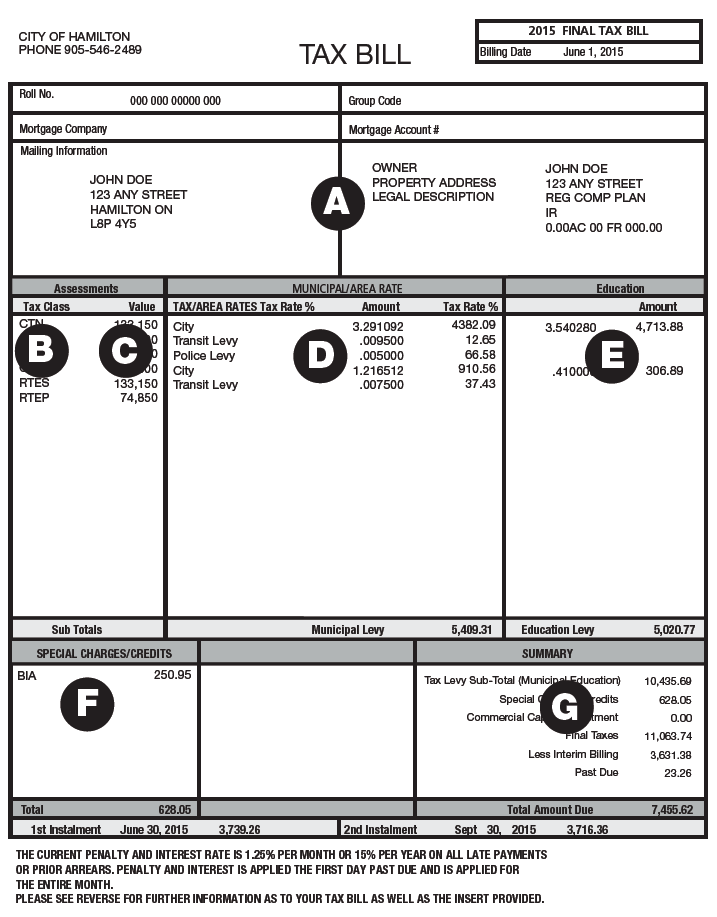

A – Property identification

This section contains identification information such as municipal tax roll number, mailing address and a legal description of your property.

B - Tax class

This section lists the classification(s) of your property (i.e., residential, farm, commercial ) and educational support. The tax class codes are explained at the top right of the page. If you have questions about education support, call the Municipal Property Assessment Corporation at 1-866-296-6722.

C - Value

This shows the current value of your property, as assessed by the Municipal Property Assessment Corporation.

D - Municipal and area rate levies

This section provides a detailed breakdown of your property taxes as set by City Council. To determine the amount of tax you pay for each service, multiply the tax rate for that service by the assessed “value” for your property.

E - Education tax

The education tax is set by the provincial government. To determine the amount of education tax you pay, multiply the education tax rate by the assessed “value” of your property.

F- Special charges and credits

This section lists charges that are specific to your property. Special charges cover a range of services including sewer and road upgrades and other local improvements. Credits refer mainly to tax rebates such as the seniors tax rebate.

G -Summary

This section lists the subtotals of your tax levy (municipal and education), tax cap and any credits or special charges.

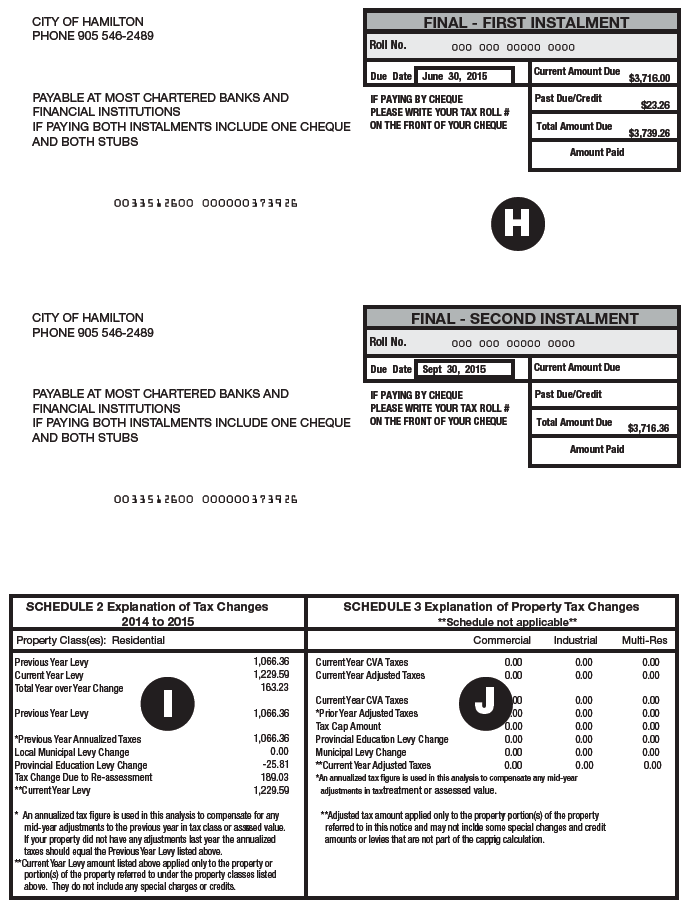

H - Payment stubs

You need to submit payment stubs along with your payment, when you pay by mail, in person or at a financial institution. If you pay by installments, submit the second stub with payment of the second installment. If you pay through a pre-authorized plan, you do not need to submit either of the stubs.

I - Schedule 2

Schedule 2 pertains to Residential, Farm, Managed Forest or Pipeline property classes. It shows the year over year change in taxes levied, from 2022 to 2023, comprised strictly of the actual taxes, excluding any special charges or credits. It is further broken down by the municipal levy change, education levy change and by any tax change due to reassessments.

J - Schedule 3

Schedule 3 pertains to Commercial, Industrial and Multi-Residential property classes. It shows the 2023 tax levied amount and the 2023 adjusted tax levied amount due to the provincial capping program. It further breaks down the difference in the tax cap amount, municipal levy change and the education levy change.

Tax Class Codes

C 0 N - Commercial Small Scale - Farm 2

C 1* - Farmland awaiting Development - Commercial

C 7 N - Commercial Small Scale - Farm 1

C T N - Commercial Taxable

C U N - Commercial Excess Land

C X N - Commercial Vacant Land

D T N - Office Taxable

D U N - Office Excess Land

E N - Exempt

F T* - Farmland

G T N - Parking Taxable

H T N - Landfill Taxable

I 0 N - Industrial Small Scale – Farm 2

I 7 N - Industrial Small Scale – Farm 1

I T N - Industrial Taxable

I U N - Industrial Excess Land

I X N - Industrial Vacant Land

L T N - Large Industrial Taxable

L U N - Large Industrial Excess Land

M 1* - Multi-Residential Awaiting Development

M T* - Multi-Residential

N T* - New Multi-Residential

P T N - Pipeline Taxable

R 1* - Residential Farmland Awaiting Development

R T* - Residential

S T N - Shopping Centre Taxable

S U N - Shopping Centre Excess Land

T T* - Managed Forest

V T N - Aggregate Extraction

* School Support

EP - English Public

ES - English Separate

FP - French Public

FS - French Separate

N - No Support